While drivers are angry at the high cost of car parts across Europe, major auto brands have bought a complex software showing how to raise prices on spares.

Between 2008 and 2013, global consulting firm Accenture worked for five big auto manufacturers, with software indicating how to increase prices by up to 25 per cent on their captive spare parts, which are design-protected.

This is revealed by confidential documents from Accenture, obtained by French online newspaper Mediapart and analyzed by The Black Sea and its partners in the media network European Investigative Collaborations, in collaboration with Reuters and De Standaard.

Our investigation shows that the Accenture software called Partneo, designed for Renault (owner of the Romanian brand Dacia), was also used by Nissan, PSA Peugeot Citroën, Chrysler and Jaguar-Land Rover. Their total gains from the price changes amount to at least 2.6 billion Euro, financed by consumers looking to repair their motors - and paying a hefty price.

This operation raises serious legal issues. The confidential documents obtained by EIC have been filed in a civil lawsuit in front of the Paris Commercial Court by the inventor of the software, Laurent Boutboul, who sold his company to Accenture in 2010.

Boutboul's allegations include the claim that the system has been used to coordinate price increases in spare parts between different car brands, in violation of competition rules.

Renault distributes around one million parts and accessories to 160 countries every day, and sells both new and reconditioned parts.

The group is especially active in eastern Europe, employing 12,000 centred on the Dacia factory in Mioveni in Romania, and 6,400 in Turkey, where it makes the Clio 4. In Russia, the group now owns the leading automaker Avtovaz, with the Lada brand.

In response, the group argued: “Renault strives to provide its customers with a wide variety of quality spare parts, the amount of which is calculated based on parameters that Renault considers fair and equitable.”

After its success with a few big names in auto, Accenture tried to sell the Partneo software to 31 of the top car brands in Europe, Asia and the USA. The consulting firm informed these leaders that several important competitors had already raised their prices between ten and 20 per cent thanks to its software, and proposed they could also benefit.

This means that Accenture seems to have informed the industry that a signifiant price increase was underway and created an incentive to follow the trend.

Accenture hit back at the anti-competitive allegations in a statement, declaring that it considers Boutboul’s accusations are “unfounded”, and that “the Competition Authority in France found that the evidence presented did not justify any further action.”

Spare Parts - the Gift that Keeps on Giving

The gains achieved by manufacturers who purchased Accenture’s software are shocking because spare parts were already a cash cow for the auto sector.

The excessive prices of components have been criticised for years by consumer associations across Europe.

Accenture’s documents detail that before the implementation of its software in 2009, manufacturers already enjoyed global profit margins up to 80 per cent. According to Accenture, spare parts have accounted for nine to 13 per cent of the turnover of car manufacturers, but up to 50 per cent of their net income.

These huge profits were mostly generated by so-called 'captive' spare parts, such as windshields and mirrors, where consumers have little choice but to buy the official part sold by the manufacturer. According to Accenture, these 'captive' parts represented 30 to 50 per cent of manufacturers' sales.

The debate on the liberalization of the spare parts market has been heated at an EU level. Currently, in many EU countries, car manufacturers hold a monopoly on the visible car parts on the basis of design and copyright laws. Nationally, it means only car manufacturers are allowed to produce and sell these parts in the aftermarket.

In Romania in 2012, the local Competition Council recommended a liberalization of the manufacturers' monopoly on visible spare parts. This move came after sales on spares increased by two per cent in 2010 on the previous year, after decreasing considerably in the previous two years. The Romanian Parliament never approved the change.

‘Captive’ sales bring in a lot of cash for the big brands, and they tend to oppose liberalization using the excuse it will lower safety standards, lead to job losses which could be outsourced outside of the EU and may not bring lower costs for consumers.

Software Hacks into Driver Psychology

Despite the huge profits on captive parts, a French expert in industrial profits, Laurent Boutboul, floated the idea of raising the prices even further. He invented a software called Partneo, and in 2006, he created a company called Acceria to develop and sell the technology.

In the mid 00s, manufacturers set the price of parts around the production cost or the purchase price, if made by an external supplier. Partneo replaced this philosophy with the concept of “perceived value”. This meant the new price would be based on how much the customer was psychologically willing to pay.

With the Partneo system, parts are weighed, measured, photographed and analyzed in a 'laboratory', to create 'families' of components which have similar characteristics. Thanks to sophisticated algorithms, the price changes are oriented on the price of the most expensive component of the 'family'. Because the components are similar in size and appearance, it appears natural they should have similar costs. Therefore the consumer is not shocked.

The first customer was Renault, and the price hikes were proposed for spare parts for their core brands, as well as the low-cost automobiles.

For example, for the Dacia Logan and Sandero, the plan set out to raise the price of the wheel arch cover from 21 Euro to 76 Euro. This is despite the fact that the component cost only three Euro for the French giant to buy from its suppliers. [As we went to press, Renault-Dacia would not confirm or deny its use of Partneo to determine the prices of spares].

But not all the car parts would rise in price. Partneo increases the prices of about 70 per cent of the parts, usually the best-sellers, and decreases the prices of 20 per cent, keeping ten per cent at the same level. As there are 10,000s of different parts and price variations for each manufacturer, it is near-impossible for outsiders to prove a general price increase.

Moreover, the software can be set to apply only moderate increases to “monitored” components, which are part of the price indexes made by car insurance companies.

After Acceria sold the software to Renault, the results were so spectacular that the operation received Renault’s internal “profitability award” in 2008. According to Accenture documents, Partneo enabled the Renault Group to increase the price of its captive parts by an average of 15 per cent, which has generated more than 800 million Euro to date [Renault disputes these figures, but states the real numbers are confidential]

Learning of this profit boost, Accenture signed a commercial partnership with Acceria in 2009 and bought the company and its software in July 2010. The consulting firm set an ambitious goal: to sell this money making tool to Renault's main competitor.

Peugeot-Citroen had “positive feedback” from Renault on software

On 17 December 2009, a sales manager at Accenture promises to PSA a price increase on spare parts between 10 and 20 per cent. “As discussed in our previous meetings, these ratios come from recent experiences with generalist car manufacturers,“ he writes.

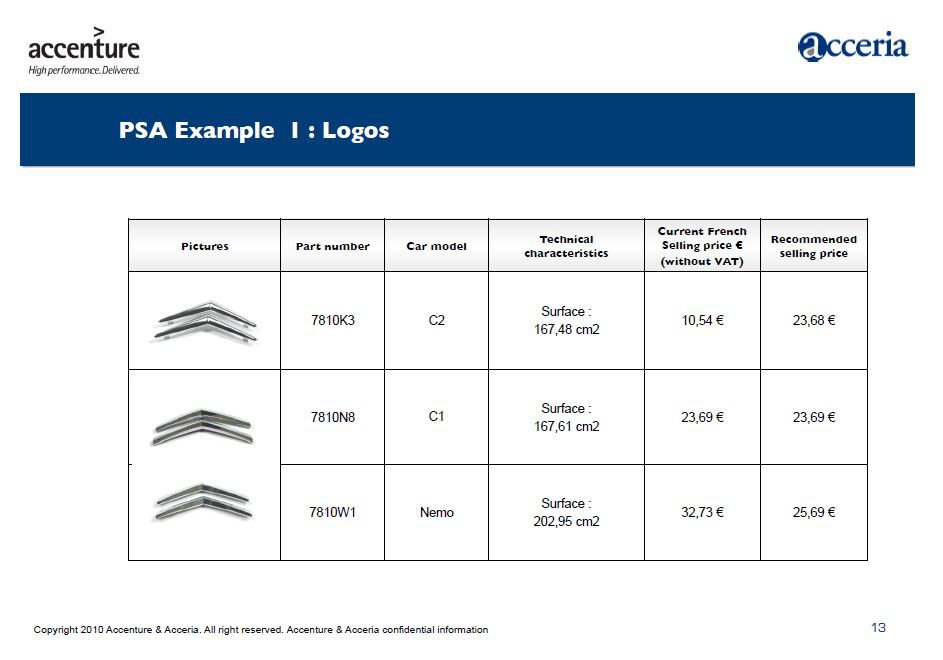

One such brand was revealed to be Renault. In a commercial presentation made for PSA at the beginning of 2010, the consulting firm indicates that its project received a “profitability award,“ with a picture of the trophy in the shape of the Renault logo. Accenture also provided examples of optimized prices with references to Renault’s parts.

It is troubling for businesses to share sensitive commercial data, and today Accenture states that it “does not exchange sensitive and/or confidential information between its customers“.

But according to the written testimony of a former Acceria employee, involved in the legal case, PSA executives had “doubt about the potential for earnings“ and “wanted to reassure themselves by talking to a client who had done a similar operation in the past“.

The proposal was a secret meeting between the spare parts managers of Renault and PSA in charge of the project. PSA confirmed afterwards that they had “very positive“ feedback from Renault and that “they would start the project with Accenture“, this witness claims.

Renault denies a secret meeting took place. “Renault has not engaged in any coordination with PSA in any form whatsoever,“ said the group in a statement, adding that “Renault has never authorized Accenture to disclose any information about itself to its competitors.“

According to Accenture’s internal documents, thanks to the software, PSA finally achieved an average price increase of 15 per cent on its captive parts, bringing in 675 million Euro to date, a similar boost to that of its French competitor.

What is at fault here?

The danger is the existence of a price agreement between car manufacturers. This is not a deal between brands to jointly fix the prices of captive spares, but instead sees them adopting a strategy that enables them to increase prices.

This is called a ‘Hub and Spoke’ practice where manufacturers act in concert with information supplied by an external party that allows them to raise prices in their own way. If proven to be at fault, Accenture would be acting as the ‘hub’, while the ‘spokes’ would be Renault and Peugeot-Citroen, along with any other potential clients.

Anti-competitive issues were a fear of Anthony Rice, legal counsel of Accenture in London, as he monitored the due diligence on Acceria in summer 2010, before the project with PSA.

“Accenture believes that there are competition law risks […] if two or more competitors adopt similar rates or pricing strategies as a result of its interaction“ with the software, writes Rice in a confidential internal email. He adds that the firm could be considered by national and European competition authorities as the “facilitator“ of an “agreement between competitors to fix prices or to use a common pricing mechanism or solution.“

To reduce these risks, Rice sent the managers of Accenture's team in charge of Partneo a document called “antitrust protocols“ for each individual supporting the business to follow. These prohibited the disclosure of any non-public, competitively sensitive information obtained from one customer with another customer, alongside any information that specifically identifies an individual company.

In addition the protocols forbid the sharing of competitively sensitive information obtained from one customer to set the pricing of a competing company and the use the same pricing formula or solution to develop recommended pricing for competing customers.

The two Accenture managers appointed as the new bosses of Acceria after its takeover committed to these rules on 28 July 2010. But in written testimonies, two separate Accenture consultants claim that they have never seen these protocols, nor had the teams in charge of the Partneo software.

In the spring of 2015, a (now former) Accenture consultant in charge of Partneo sent an email alert to Peter Malone, Accenture's Compliance and Ethics Counsel, and Sean Duffy, the firm’s Competition Law Counsel. He claims that he just discovered the existence of the antitrust protocols and has concerns over their compliance.

This consultant writes that Accenture disclosed to PSA the “Renault-Nissan prices levels, explicitly in 2010 and implicitly after“, that the firm “informed PSA that Renault uses the same algorithms and formulas for price definitions than those proposed to PSA“, which have “helped PSA to increase its prices in the same proportions as the increases made by Renault“.

“Non-public information from Renault has been used in PSA's pricing process,“ the consultant adds. “It is the use of these data from a competitor that is a concern to me.“

“An investigation deserves to be conducted by the European Commission”

To check whether the case could be considered an illegal pricing agreement, the inventor of the software submitted the confidential documents to a French expert - Emmanuelle Claudel, professor of competition law at the University Paris II Panthéon-Assas.

The conclusions of her 46-page report state that it is “possible to reasonably suspect the existence of a horizontal price agreement between the companies Renault, PSA and Accenture, taken as a facilitator“.

Professor Claudel adds that “an investigation deserves to be conducted“ by the European Commission’s Directorate General for Competition, given “the economic importance and the sensitivity of the sector concerned... and the weight of the operators involved.“

However today, the French Competition Authority has already received information on a “presumed“ agreement between auto manufacturers.

“These elements have not justified at this stage the opening of a investigation,“ the Authority said in the statement. “The analysis conducted by the investigating services is based only on the elements that have been brought to their knowledge, and these services retain the power to open an in-depth investigation, for example in the event that new elements are communicated to them.“

In a short note in response to the allegations outlined in this article, PSA stated they are “unfounded“.

Meanwhile Renault said in a statement: “We do not consider that our company has at any time taken a step that may be, in any way, a violation of the competition rules. Renault places compliance with the competition rules at the heart of a compliance process that is essential to the running of the company.“

World Tour for Price-Rising Tech

After Renault-Nissan and PSA, Accenture sold the software in 2011 to Mopar, the spare parts distribution company of Chrysler. According to our confidential documents, the American car-marker increased the prices of its captive spare parts by 13 per cent, generating 420 million Euro to date.

Given this success, Fiat, which took control of Chrysler in 2009, showed interest. According to our documents, the Italian group paid Accenture for a pilot test of the software for Fiat on the Italian and Brazilian markets, and a second for its subsidiary Ferrari. After a simulation on 4,000 spare parts, Accenture promised Ferrari a 15 per cent price increase on captive spare parts.

The Fiat pilot results are not available. But after the Fiat-Chrysler merger that created the FCA Group in 2014, Mopar became the spare parts distributor of all generalist brands of the group, including Fiat, Lancia and Alfa Romeo. Has FCA finally enforced the price increases to the spare parts of its Italian brands? The Group would not respond to questions.

Jaguar Land Rover also enjoyed the smart software from 2013. The British manufacturer (now owned by India's Tata Motors) enjoyed an average price increase of nine per cent on its captive spare parts, earning 160 million GBP to date.

The pricing gains implemented by Accenture for its clients are similar and, in most cases, between 13 and 16 per cent. In the alert filed in 2015 by the Accenture consultant to Accenture’s compliance department, he claims that “our automotive clients were aware that we had an industrial pricing approach, that can be deployed and adapted to them.“

He adds: “The pricing rules that we recommend are extremely similar from one client to another“ and have been implemented using a “common algorithm“. This contradicts Accenture’s antitrust protocol, which forbids using the same formula or solution to develop recommended pricing for competing customers or throughout the industry.

Further members of the auto sector seems to have been a target for the software. According to our documents, Accenture tried to sell the software to 31 car manufacturers, including Volkswagen, BMW, Daimler/Mercedes, Volvo, Aston Martin, Toyota, Mazda, Honda, Mitsubishi, Hyundai, General Motors and Ford.

EIC obtained four different Accenture presentations shown to Mitsubishi, Volvo, BMW and Honda and states that several big carmakers already enjoyed this sales boost.

It seems Accenture spread the word to the whole industry that the firm operated a major price increase in several big players, creating an incentive for the others to follow, even if they did not buy the software.

“All the commercial presentations were made the same way and always included a slide indicating the gains obtained by our main customers,“ states a former Accenture consultant in an email.

Did Accenture disclose too much information? The firm's antitrust protocol states that the consultants could, with prior approval of the previous customers, present anonymized “historical data of at least three companies“ which corresponds to the content of the presentations.

But the same protocol also forbids disclosing or sharing “any non-public, competitively sensitive information obtained from one customer with another customer“ and also forbids advertising or suggesting “that the company can or will provide industry-wide pricing or a uniform solution in any industry.“

BMW, Daimler, Toyota, General Motors, Volvo and Volkswagen all told EIC that they did not go on to purchase the software.

Main Opening Picture: copyright Petrut Calinescu

Additional reporting by Catalin Prisacariu and Michael Bird